Disposable Income Verification

The absence of technology and digital processes in validating user financials poses business risks and hampers the end-user experience by relying on traditional methods that are time-consuming and prone to errors. Disposable Income Verification allows you to easily validate end-user financials through real-time access to their transaction history, ensuring swift and secure affordability and financing decisions.

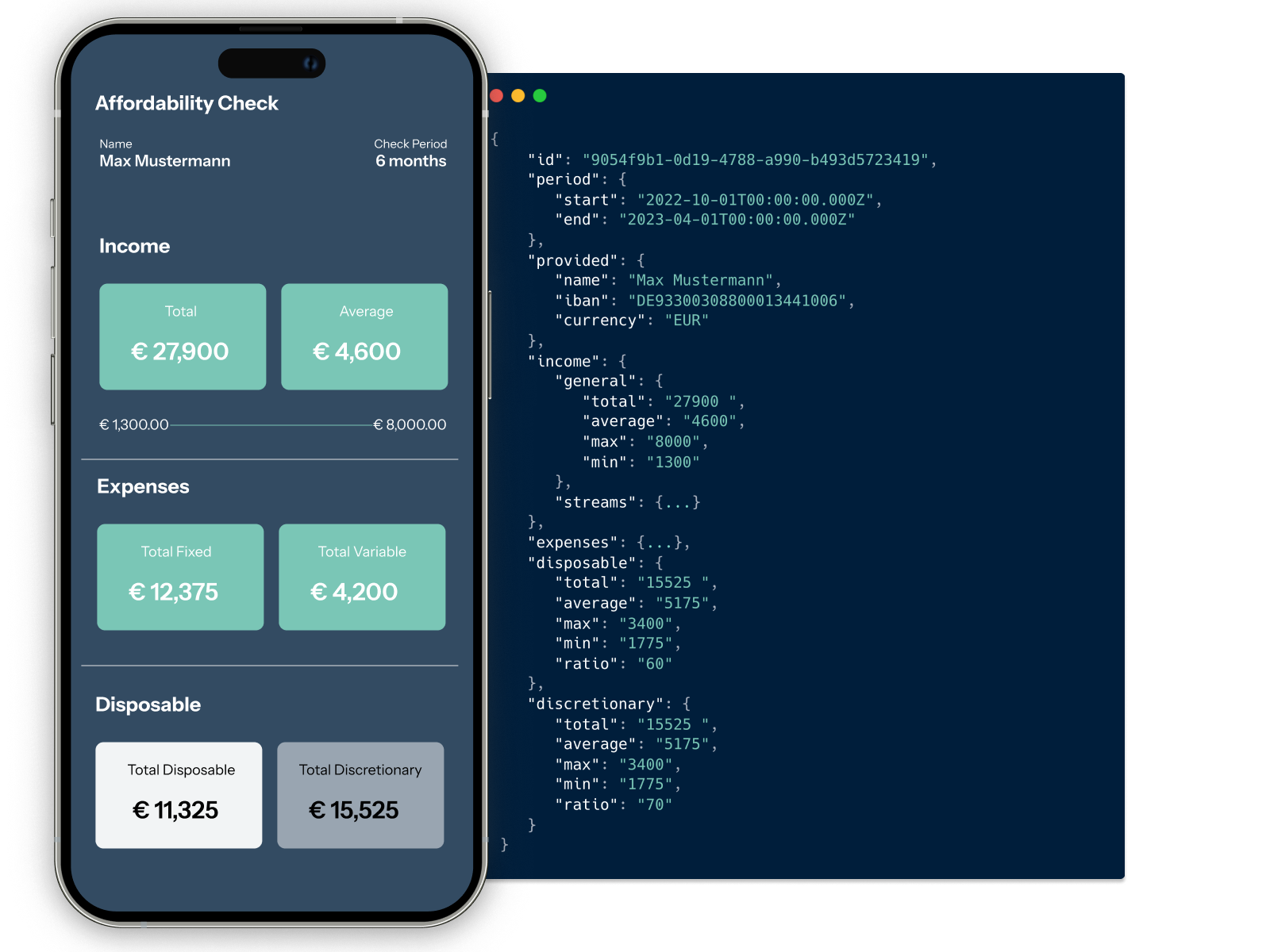

With real-time access to bank account data, Disposable Income Verification enables you to retrieve aggregated and averaged amounts of regular income streams as well as regular and irregular expenses. This helps determine the creditworthiness of end-users. Further enrichment, such as categorizing different income streams and expenses, adds an extra layer of transparency to the overview of the user's financial situation and reduces your financial risk. All manual work and effort on your side are eliminated. As a result, you're empowered to make faster, better data-driven decisions.

How it works

You send a request to our API for Disposable Income Verification of the end-user.

The end-user has to go through the account connection process by entering the credentials and followed by the steps for Strong Customer Authentication such as confirming the account access in the banks TAN app.

Upon successful completion, you retrieve the Disposable Income Verification result from the finX API, which includes income, expenses and disposable income information.

Demo Disposable Income Verification

Do you want to try how the process and the user flow will look like? Let us know!