Financial Data

Difficulties in verifying customer information can pose security risks and hinder the end-user experience when relying on traditional, time-consuming methods that are prone to errors.

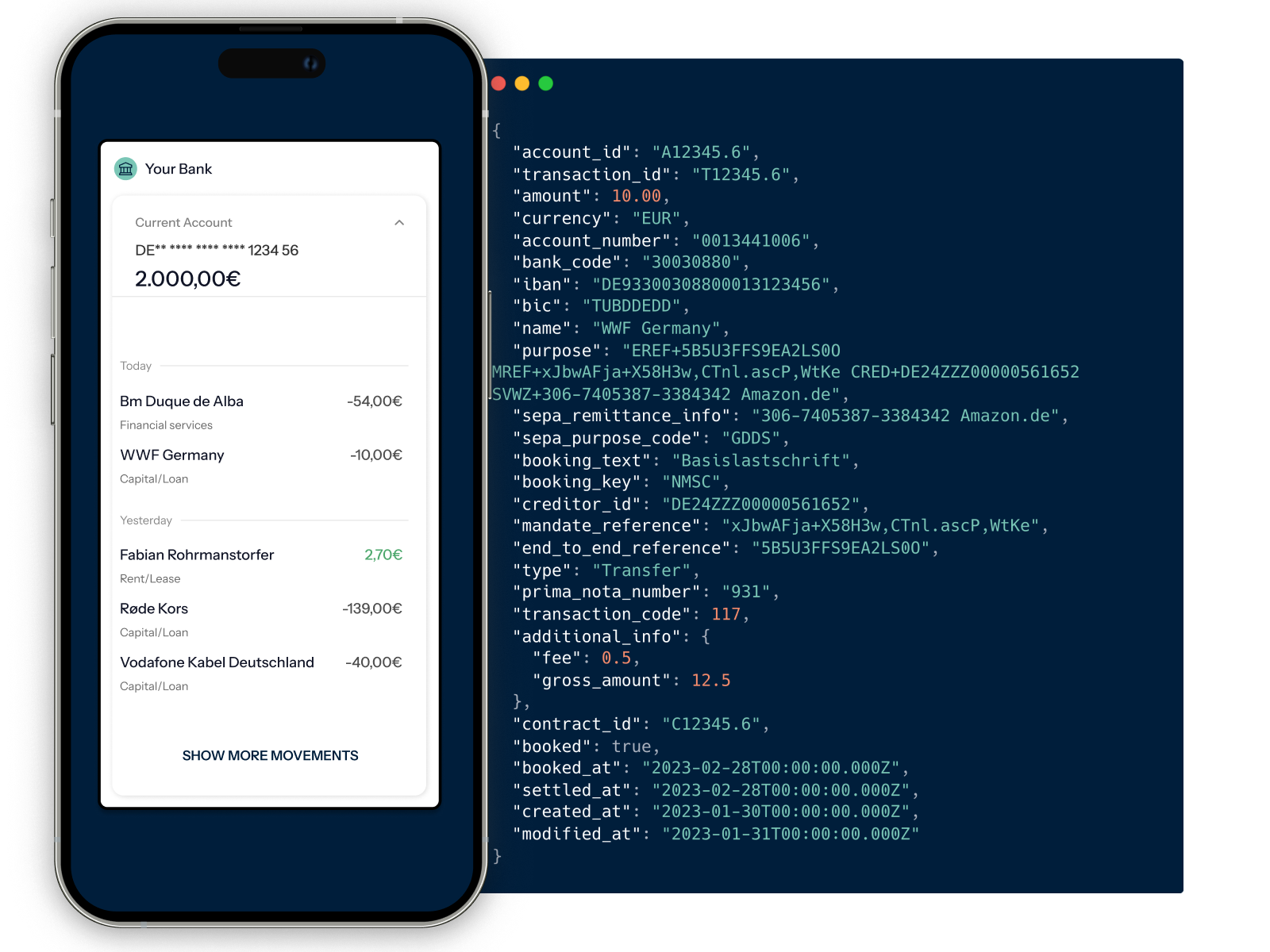

Our product, Financial Data, enables you to effortlessly gain financial insights by providing real-time access to an end-user's bank account. This ensures quick and secure processes and decisions.

Access to Financial Data allows you to tap into an extensive range of financial information from banks and financial service providers across Europe. To achieve this, end-users connect their bank accounts or financial services through our API, which can be implemented in your application. Qwist connects and harmonizes data for retail and business accounts from > 3000 financial sources in Germany, Austria, Portugal, and Spain.

How it works

To get the financial data of the end-user, you send a request to our API and get as a response a URL to forward the user to our widget user interface. If you have your own account information license, you can of course build all frontend parts of the account connection flow yourself utilizing our API in the background.

The end-user is required to complete the account connection process by entering their credentials and following the Strong Customer Authentication steps. This includes confirming account access within the bank's TAN app.

After successful completion of these steps, you can retrieve financial data, including account information and transaction history from the connected accounts

Demo Financial Data

You want to try how the process and the user flow will look like? Go ahead and give it a try now – it's incredibly simple and fast!