Risk Insights

Challenges in obtaining comprehensive insights into an end-user’s financial situation pose business risks and hinder the end-user experience by utilizing traditional methods that are time-consuming and prone to errors.

Third-party credit bureaus are a common source of information, yet they often have limitations, providing only the applicant's credit exposure and sometimes outdated data.

Furthermore, the application process can become highly cumbersome, demanding significant manual input and paperwork from customers.

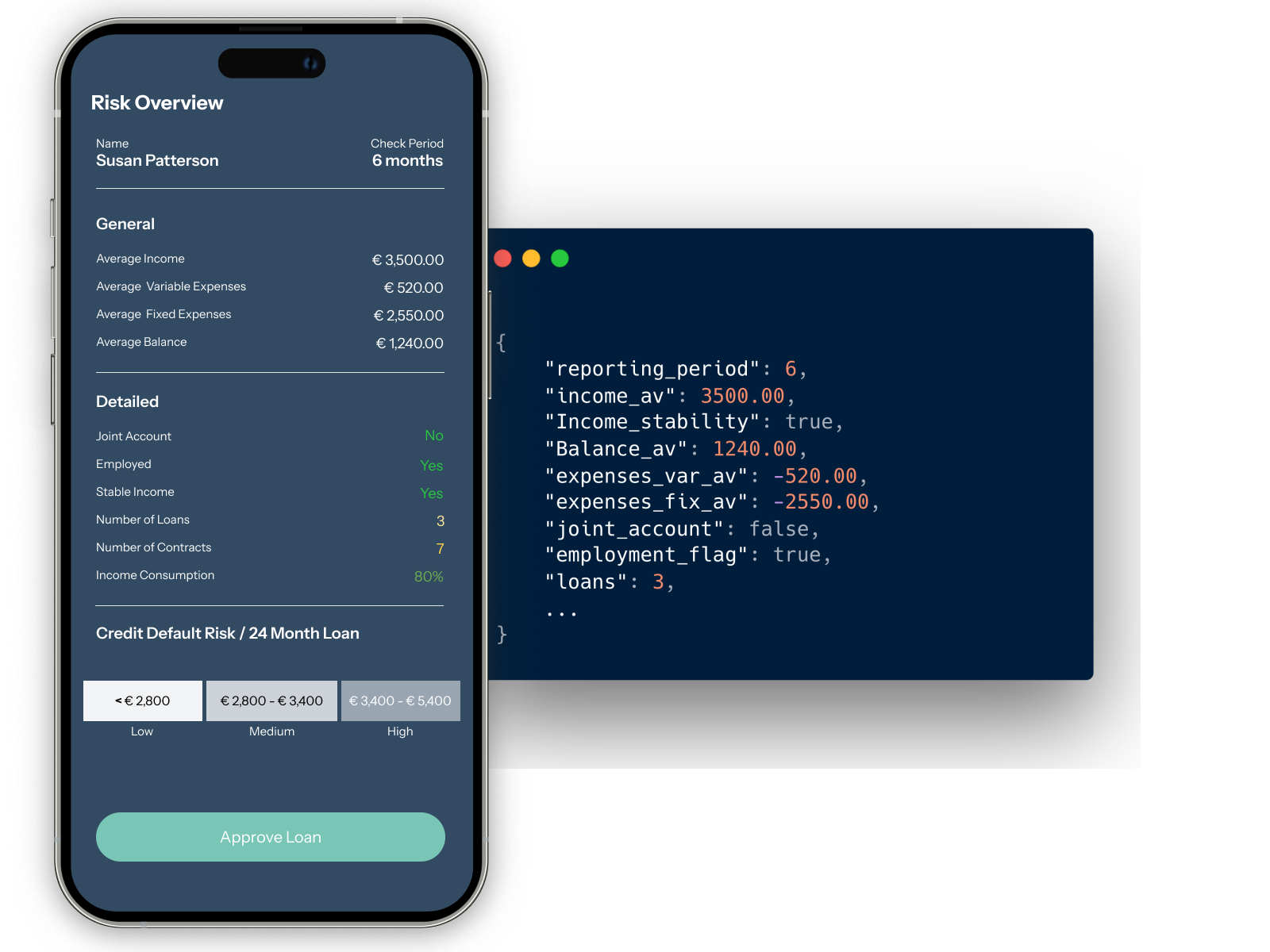

With our risk insights product, customers can enhance credit checks by utilizing up-to-date information about applicants' risk behavior and spending habits. This information is derived from real-time transaction data analysis. As a result, customers can offer end-users a swift, hassle-free experience through a seamless, fully digital application process.

How it works

You send a request to our API for risk insights for one specific end-user.

The end-user has to go through the account connection process by entering the credentials and following the steps for Strong Customer Authentication such as confirming the account access in the bank's TAN app.

Upon successful completion, you retrieve the risk insights data such as with a real-time Affordability check, Liquidity forecast, or Credit Default Risk.

Demo Risk Insights

You want to learn how the process and the user flow will look like? Get in touch!