Multibanking

Incomplete data on spending behavior and other customer insights hinder the ability to present appropriate and highly valuable products to users. Multibanking offers a seamless and comprehensive view of the customer's finances, enabling the provision of personalized financial gains and valuable individualized products.

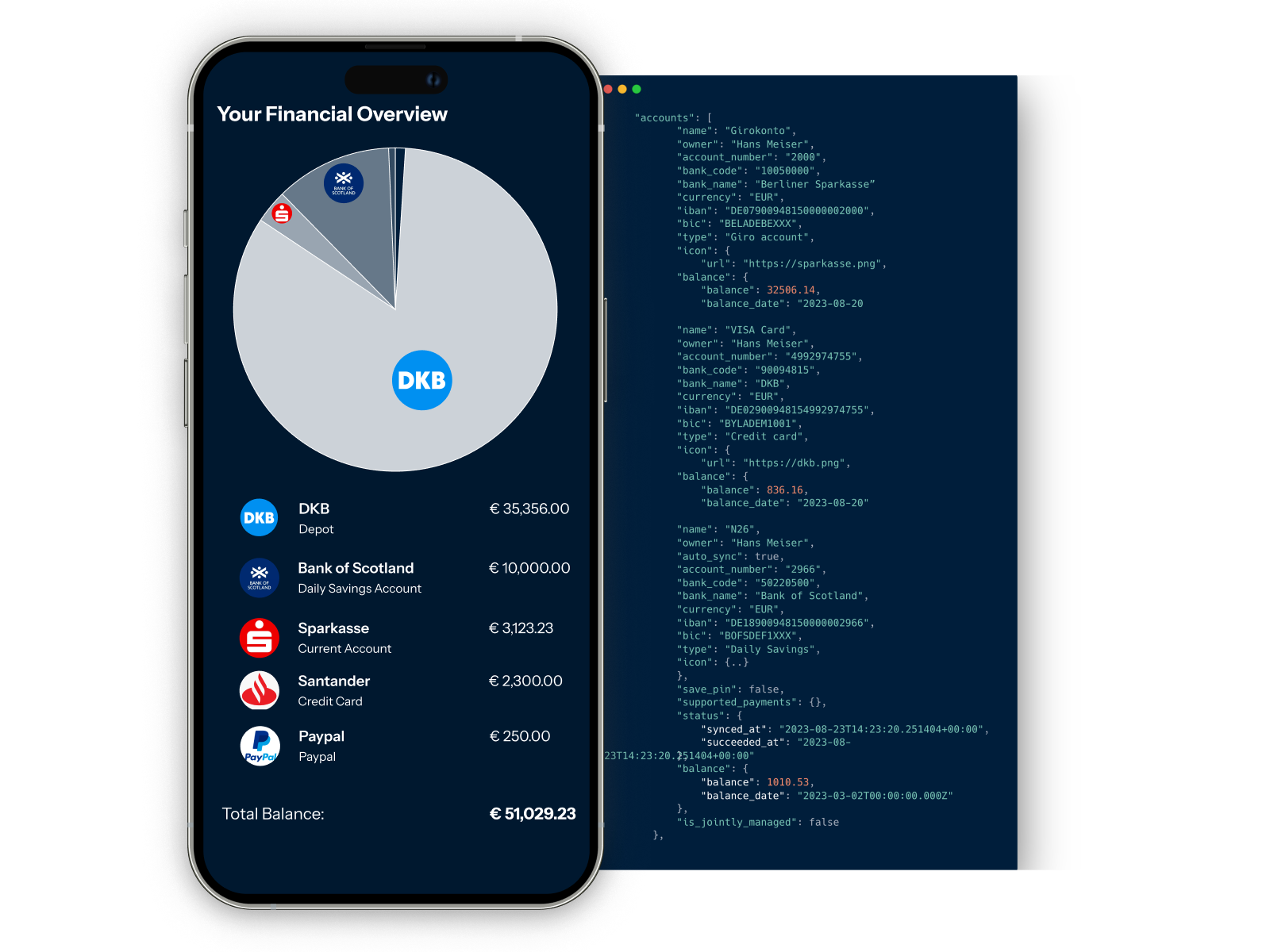

Our Account Aggregation streamlines the data collected from diverse banks and account types via various connectivity sources into a unified format. This format empowers customers to significantly enhance their data analysis capabilities for users.

Our Multibanking service empowers you to allow your users to connect all their financial accounts in one consolidated platform. This, in turn, facilitates the delivery of hyper-customized offers by providing intricate, real-time insights into users' spending habits across all their bank and financial accounts.

Furthermore, it offers the ability to comprehend how users leverage all their bank accounts to generate financial benefits for both users and banks.

By harmonizing and aggregating transaction data across all bank and financial accounts, customers can deliver invaluable insights to their users concerning their spending behavior. This not only helps prevent payment defaults and unnecessary overdrafts but also enables the offering of valuable financial products like credit cards.

How it works

Data aggregation, presented as a Financial Timeline, offers the capability to access a series of data points that illustrate the evolution of specific account attributes over time. These data points are sampled at a user-configurable frequency (daily, weekly, monthly, quarterly, yearly), and the corresponding aggregated values are displayed for each period.

To provide a clearer insight into a user's spending patterns or income sources, our API facilitates the aggregation of transactions based on specific parameters such as categories. This aggregation can be performed for an individual account, all accounts associated with a single bank, or across multiple banks for a user.

Irrespective of the account type or financial institution, all financial data is standardized into a unified data structure, ensuring easy and convenient utilization within customers' Multibanking applications. End-users benefit from a comprehensive overview of their entire financial landscape, eliminating the necessity of accessing individual bank online platforms to check balances or transactions.

Demo

You want to try how the process and the user flow will look like? Go ahead and give it a try now – it's incredibly simple and fast!