Payment Initiation

The challenge of not being able to provide payment services independently hampers the end-user experience and business value for customers by relying on traditional methods that disrupt their end-user flow, are time-consuming, and are prone to errors.

Payment Initiation powered by Open Banking allows customers to seamlessly implement payment initiation through real-time access to an end-user's bank account, ensuring swift and secure payment initiations.

Our Payment Initiation Services enable B2B customers to offer their end-users the ability to initiate a bank transfer (Single Euro Payments Area (SEPA) Credit Transfer in the EU) from the payment account they hold with their bank.

Payment Initiation Services offer an alternative to online payments using credit cards or debit cards or manually copying merchant bank details for settling open invoices through the end-user's online banking.

How it works

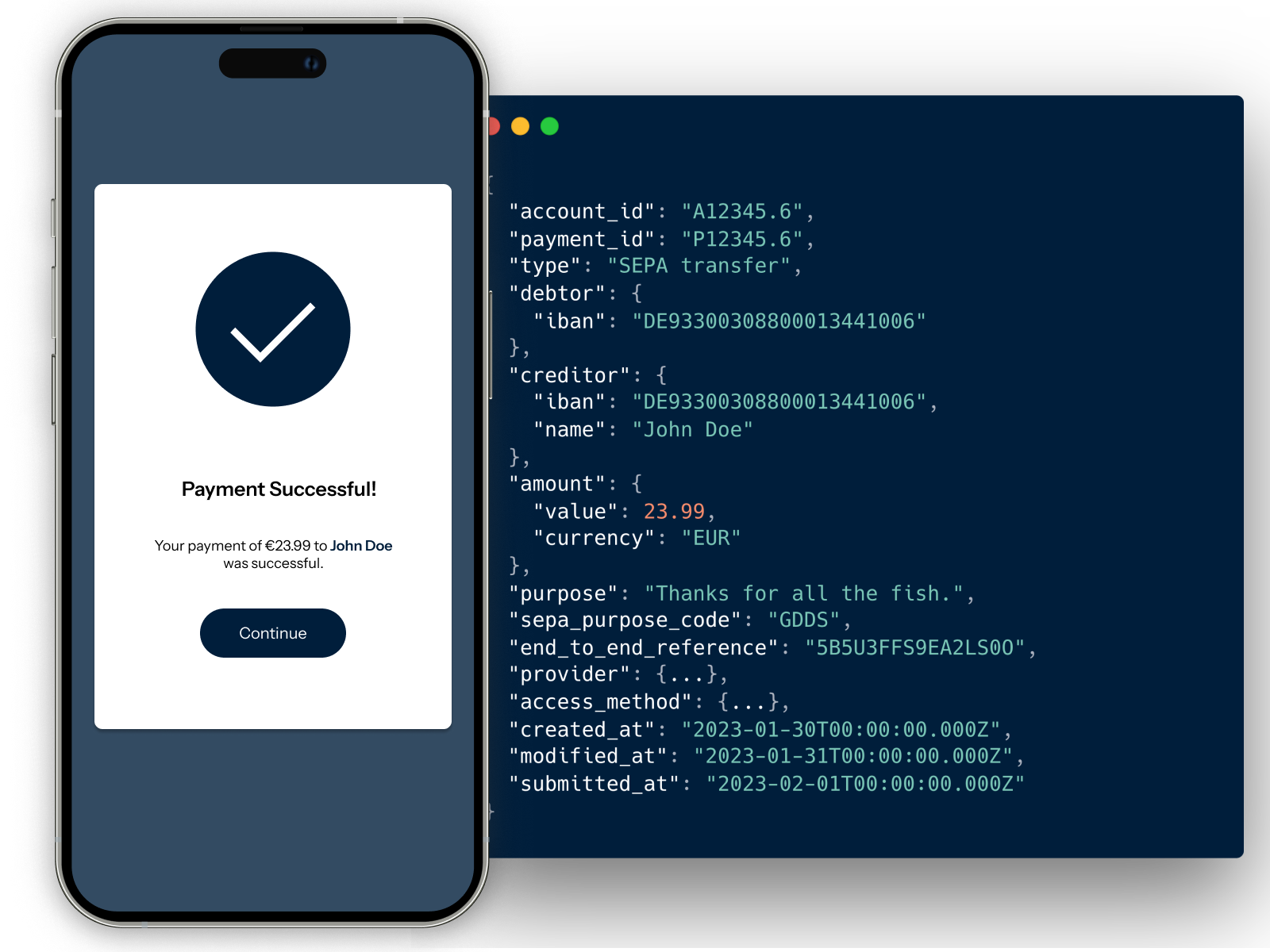

You send a request to our API for payment initiation, which contains all relevant payment details.

The end-user has to go through our payment initiation process, entering credentials, and providing Strong Customer Authentication to authorize the bank transfer.

Upon successful completion, you will retrieve the payment initiation result from our API immediately, which includes all payment details as well as the payment initiation timestamp.

Demo Payment Initiation

Do you want to try how the process and the user flow will look like? Please reach out!